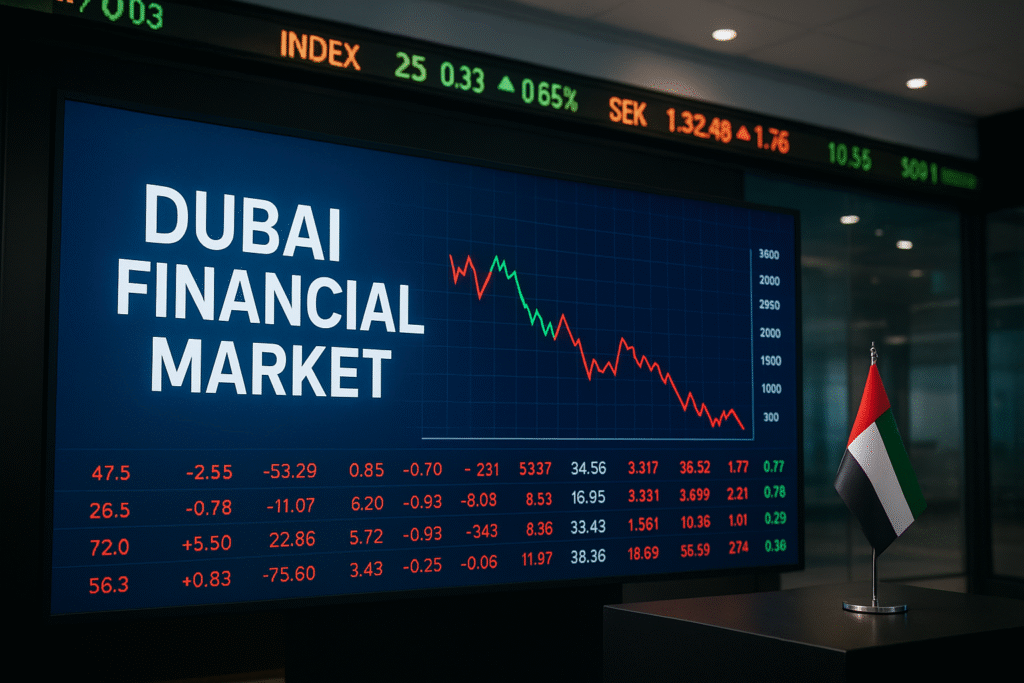

UAE stock markets

It was a classic tale of two cities in the UAE’s financial world this Friday. While Dubai stocks showed cautious optimism, their Abu Dhabi counterparts extended a gentle retreat – painting a picture of markets caught between corporate strength and global uncertainty. Here’s what every investor needs to know about this pivotal week.

Dubai’s Resilience Shines Through

Dubai’s main index nudged upward, powered by solid performances in three key sectors:

- Materials stocks led the charge

- Financial giants built on recent gains

- Industrial blue-chips saw fresh buying interest

Construction and manufacturing leaders attracted particular attention, while select banks rode momentum from stronger-than-expected Q2 results. But here’s the twist: despite Friday’s green numbers, Dubai’s market still closed the week slightly in the red overall. Market watchers see this as a healthy consolidation phase – investors carefully balancing profit-taking against new opportunities.

“The market’s catching its breath,” explains financial analyst Rashed Al-Mansoori. “If oil stabilizes or geopolitical tensions ease, we could see Dubai regain upward traction quickly.”

Must Read This: https://financialgoals.online/stock-market-mystery/

Abu Dhabi’s Gentle Pullback

Across the border, the Abu Dhabi Securities Exchange (ADX) marked its third straight session of modest declines. Don’t sound alarm bells yet though – this appears to be limited profit-taking as earnings season winds down. Energy and banking heavyweights drove most of the dip, yet crucially:

- The ADX remains near recent highs

- Pullbacks stayed measured

- Underlying confidence seems intact

Traders are eyeing oil prices like hawks. As ADX veteran Fatima Hassan notes: “Any sustained oil recovery would immediately flip sentiment. But with current volatility? Everyone’s watching the next move.”

The Oil Factor: Market’s Pulse Check

Crude prices dominated conversations all week, slumping on dual concerns:

⚠️ Fears of slowing global demand

⚠️ Rising U.S. inventories

All eyes turned to Friday’s high-stakes U.S.-Russia talks. The implications?

- Any thaw in tensions could further pressure oil short-term

- Failed talks might revive supply fears, boosting prices

This oil rollercoaster directly impacts UAE markets more than any other variable.

GCC Divergence: Regional Ripples

The split personality wasn’t unique to the UAE:

| Market | Performance | Key Drivers |

|---|---|---|

| Saudi Arabia (Tadawul) | ↘️ Down | Oil-sensitive stocks dragged indices; mixed corporate guidance |

| Qatar Exchange | ↗️ Up | Foreign investor influx + strong banking earnings |

What’s Next for UAE Markets?

The coming week hangs on three critical levers:

- Oil price trajectory – Still the dominant mood-setter

- Global data dump – U.S. inflation figures + Chinese industrial output

- Geopolitical developments – Especially around energy corridors

“UAE markets are treading water between solid corporate health and external pressures,” observes Emirates Financial Group’s Thomas Wright. “The next catalyst – whether oil rebound or key data – will determine if we break upward or test lower supports.”

The Bottom Line

This week’s mixed UAE stock performance reveals markets at a crossroads. Dubai’s sectoral strength battles Abu Dhabi’s energy-led caution, while oil prices and global tensions keep traders on edge. For investors, patience remains key – but prepare portfolios for potential volatility ahead.